Revolut is enabling users to buy products, book flights and pay for vacations with crypto – just like any other global currency – all via its mobile finance app. Rose Dykins reports

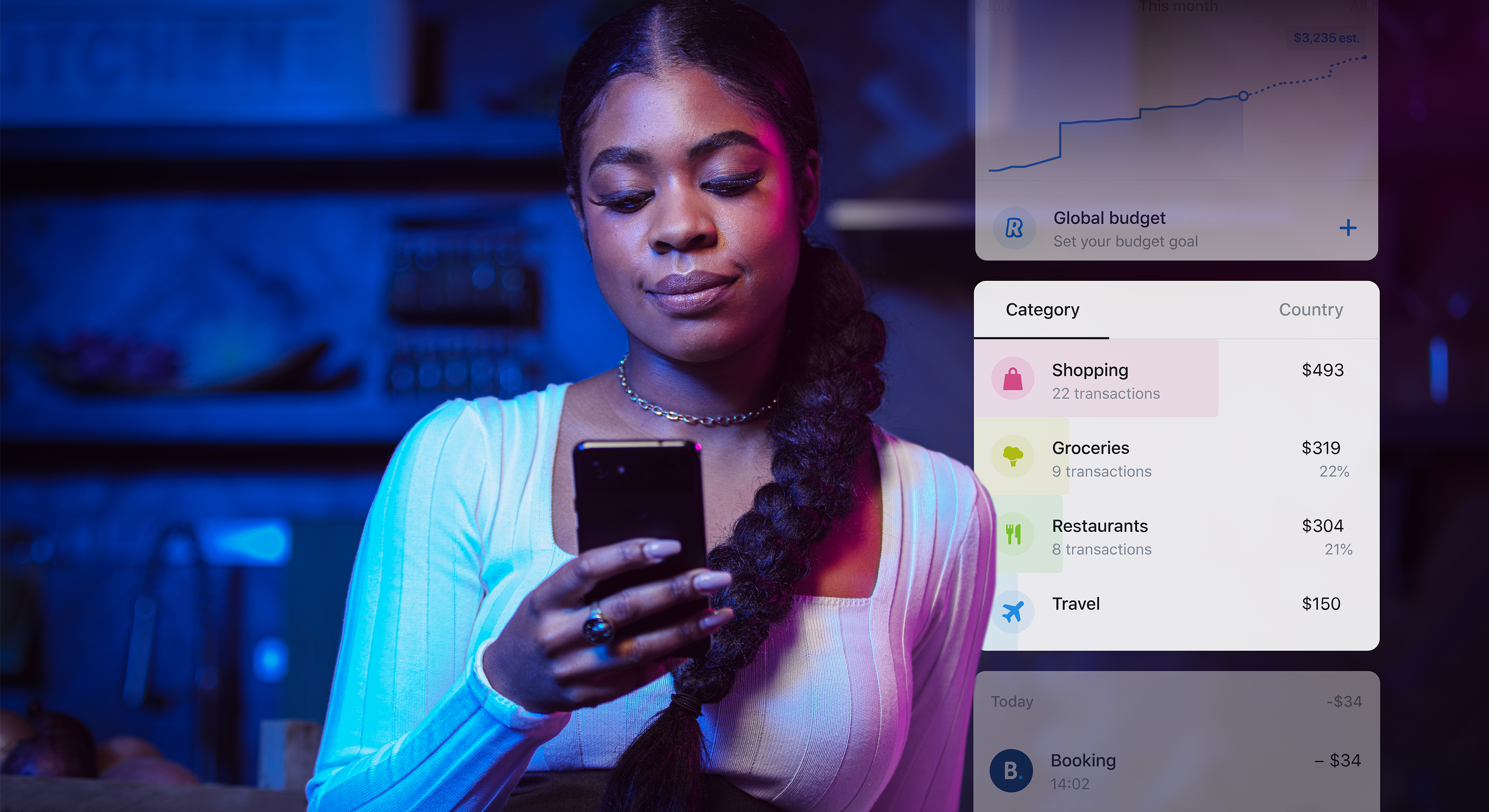

Users of finance app Revolut are now able to make purchases and pay their bills with certain cryptocurrencie via a new “spend from crypto” feature.

What’s more, first-time investors in the cryptocurrency realm will be able to use Revolut to explore this as an opportunity and invest in the digital currency for as little as US$1, and monitor the changing value of their investment via the app.

Revolut’s new service helps users invest in Bitcoin, Ether and more than 90 other tokens from more than 30 cryptocurrency service. The app can be used to buy, sell or trade crypto with friends.

Once the app has been synced with a designated payment card, it’s possible to make payments with your preferred cryptocurrency for everyday transactions (exchange fees will apply). Payments can also be rounded up with the spare change invested back into crypto investment.

The app will also help users monitor the fluctuations of the crypto trading market through notifications and news updates, and set target prices for crypto investments – receiving an in-app notification when an investment has matured to reach a set target price.

In other news, finance app Moneygram has also launched a cryptocurrency service. Users can trade and store Bitcoin, Ethereum and Litecoin via the app. The company expects to increase its future selection of crypto coins as it explores expansion to other markets in 2023.

Moneygram’s cryptocurrency service is made possible through the company’s existing partnership with Coinme, a licensed crypto exchange and crypto-as-a-service provider.

Since 2021, MoneyGram and Coinme have worked in partnership to expand access to crypto by creating thousands of new locations in the US for consumers to buy and sell Bitcoin with cash.

Alex Holmes, chairman and CEO of MoneyGram, says: “Cryptocurrencies are additive to everything we’re doing at MoneyGram. MoneyGram enables instant access to over 120 currencies around the globe, and we see crypto and digital currencies as another input and output option.

“As a next step in the evolution of MoneyGram, we’re thrilled to provide our customers with access to a trusted and easy-to-use platform to securely buy, sell and hold select cryptocurrencies.

He adds: “As consumer interest in digital currencies continues to accelerate, we are uniquely positioned to meet that demand and bridge the gap between blockchain and traditional financial services thanks to our global network, leading compliance solutions and strong culture of fintech innovation. We are excited for this next chapter in our journey.”

German digital bank N26 is also expanding its crypto trading offering from Austria to five new markets – Germany, Switzerland, Belgium, Portugal and Ireland.