Jared Jesner, founder and CEO of peer-to-peer travel money service WeSwap, speaks to Globetrender about his innovative foreign currency exchange app, and why crowdsourcing is the future of finance.

What is WeSwap?

WeSwap is a peer-to-peer travel money service – instead of sourcing currency from banks, our technology automatically exchanges currency between users. Ultimately, we help travellers get much better rates when they spend abroad, because we cut out many of the middlemen involved in the typical travel money supply chain.

When was it founded and why?

I founded the company in 2011 and we fully launched WeSwap in 2015. It was started to address what I saw as a huge inefficiency and a profound lack of transparency in the foreign exchange space. Here’s a video from our crowdfunding campaign where I talk about the market background and the “Eureka moment” for WeSwap (the relevant section is up to 1:08).

Describe a typical user

I’m proud to say that our userbase is hugely varied and from all walks of life, which is really fulfilling – it’s important to us that we’re making fairer holiday money accessible to all. But if we were to describe a typical WeSwap user, they would be probably in their late twenties to mid-thirties, trying to travel as much as they can around their nine-to-five jobs.

They’re interested in better digital solutions, and savvy in that they’ve spotted the fees their banks charge – probably having come home to shocks on their statement after a trip before – and are looking for a better alternative.

But as I’ve mentioned, we’ve also got a huge number of families on board, older empty nesters, business people and backpackers. That variety is a great feature of our community and something we’re really proud of.

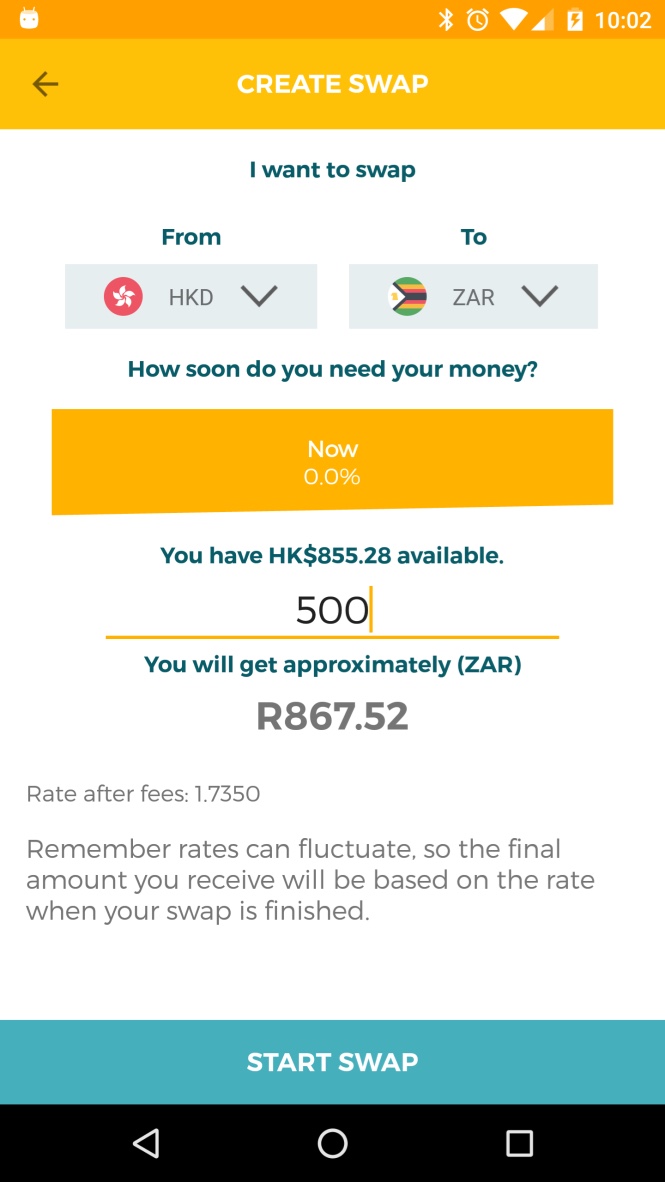

How does it work?

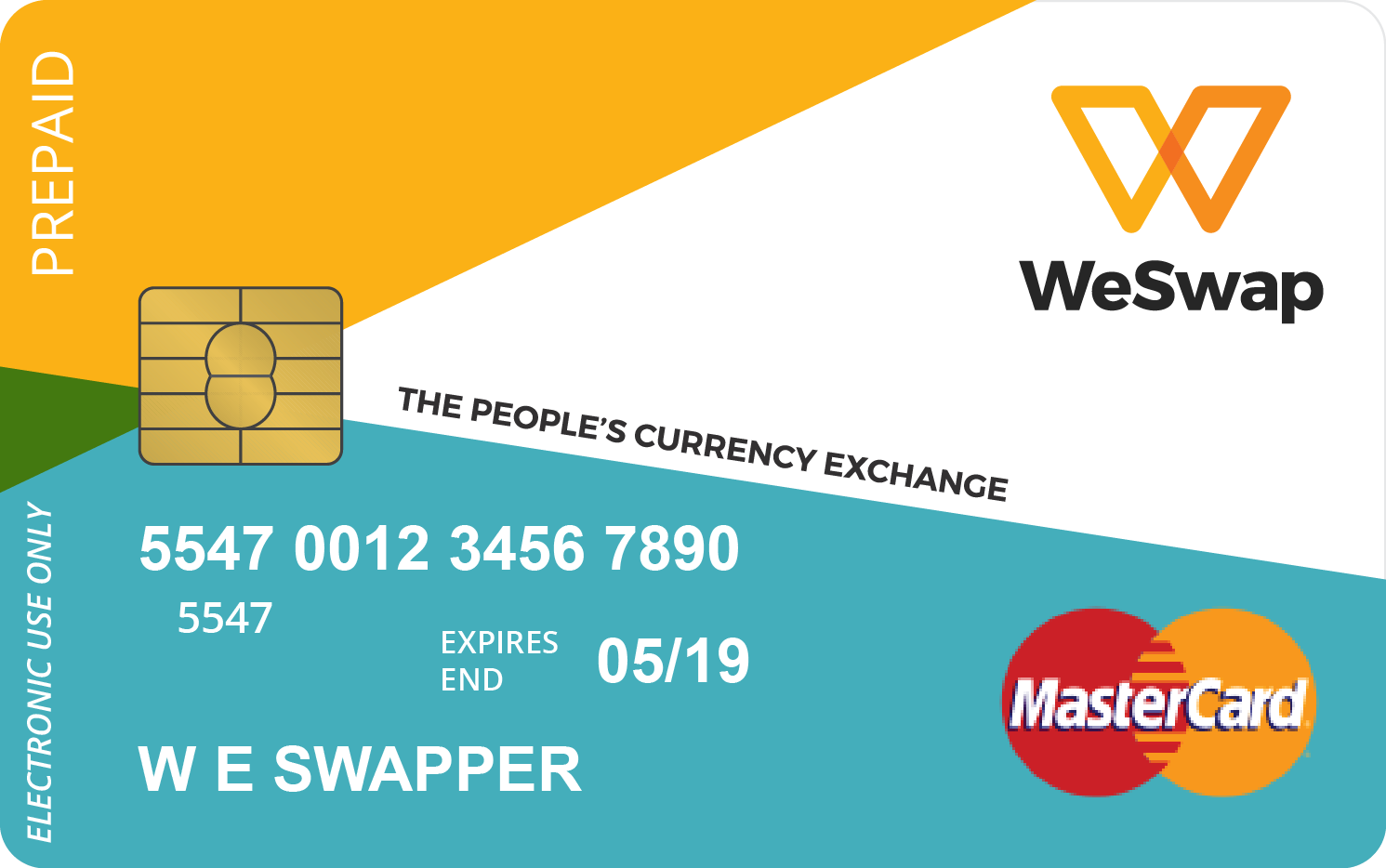

The technology is the complicated bit; using the product is actually very simple. Users sign up via the WeSwap app or online at weswap.com and apply for a WeSwap Mastercard. Through the app, users add funds to their account, exchange currency and keep an eye on all their travel spend and transactions on the card.

There’s no effort required on the user side – WeSwap automatically exchanges their currency through our platform, so all they need to do is spend. We’re also recently launched a cash option for travellers, and we’re currently trialling a credit addition to help users spread the cost of travel.

Why is it innovative?

No one else in world operates a peer-to-peer travel money platform for holidaymakers.

How can it save people money?

A user exchanges currency with WeSwap at the interbank rate (the real one you see on xe.com or on Google) and we charge a low, transparent, upfront 1-2 per cent fee. Spending on the card is completely free.

Bank cards typically charge upwards of 3-4 per cent when you use them abroad, and most high-street bureaux will add a margin of 4-8 per cent onto the exchange rate (which rises up to 15 per cent at airports). So the savings add up very quickly.

What was your journey to becoming co-founder of WeSwap?

The idea first stemmed from my experiences trading currency derivatives at JP Morgan & Dresdner Kleinworts. I saw first-hand the rates the markets exchange at and was frustrated at the fact that there was no way for consumers to access that same rate.

Then I went on to manage technology delivery for Shell, where my exposure to the payments industry solidified how the WeSwap idea could all work in practice. And that was that – I left my role at Shell to start WeSwap and the rest is, as they say, history.

How many users do you have?

Since 2015 we’ve grown to over 300,000 users across Europe, and exchanged in excess of £95 million through the platform.

What are your ambitions for growth?

Ultimately, we want WeSwap to be funding the world’s travel adventures. Expansion into new markets such as Asia, the US and Australasia is a big focus, and we plan to expand into our first non-European market in 2018.

Next year we’ll also be launching a new product for business travellers. In terms of userbase, we’re forecast to grow to a million customers by the end of 2019, rising to 3.5 million by 2022.

In the nearer term, by the end of the year we’ve got a suite of new features planned that will further help travellers manage their money abroad, like in-app advice on how much they should budget abroad, based on traveller data; a “smart swap” to help users exchange currency at the best time; plus a way for holidaymakers to save up for their travel over time.

We’re also in talks with the wider travel industry about leveraging the WeSwap platform to provide services such as supplier payments, for them. So it’s a really exciting time for the business with lots of great stuff ahead.

What is the future for digital banking and forex?

1. We’ll continue to see start-ups driving huge improvements in user experience and customer service. A typical UK Bank has a shockingly low NPS (customer satisfaction) score of just +2, with the largest bank in the UK holding a record low score of -24 (according to Frontline Ventures’ September 2017 report).

Fintech businesses will develop products and a level of customer personalisation that delights customers and tempts them away from the traditional banks.

2. Crowdsourced everything: from crowdsourced currency and loans to crowdsourced advice on spending, we expect the power of the crowd to be a core part of the future.

3. Deep-rooted change: all digital banks rely on aged banking infrastructure. These archaic systems slow down the movement of money and are costly to run. Much of the cost is passed on to consumers. Innovations such as bitcoin and blockchain technology will likely replace these old systems, enabling fundamental improvements to the whole banking experience. For consumers this will mean faster, safer and cheaper banking services.